Group savings plans provide a collaborative way to save money towards a shared goal. TransferXO offers a Group Savings Plan that allows users to form savings groups, contribute funds, and benefit collectively. This guide walks you through the process of starting a Group Savings Plan on the TransferXO web app.

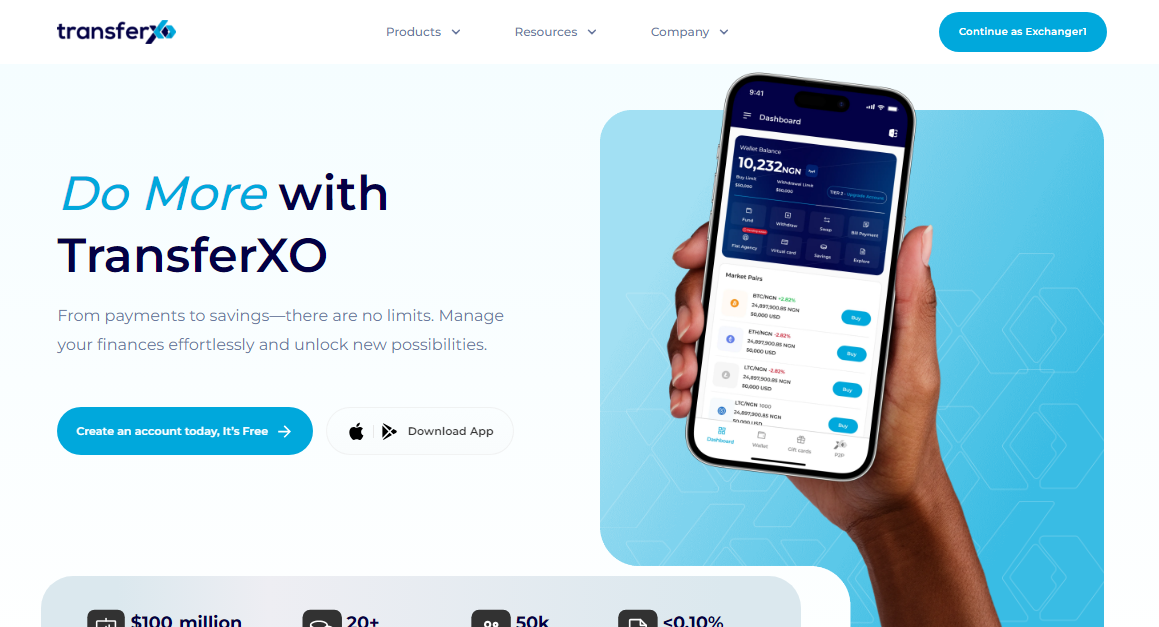

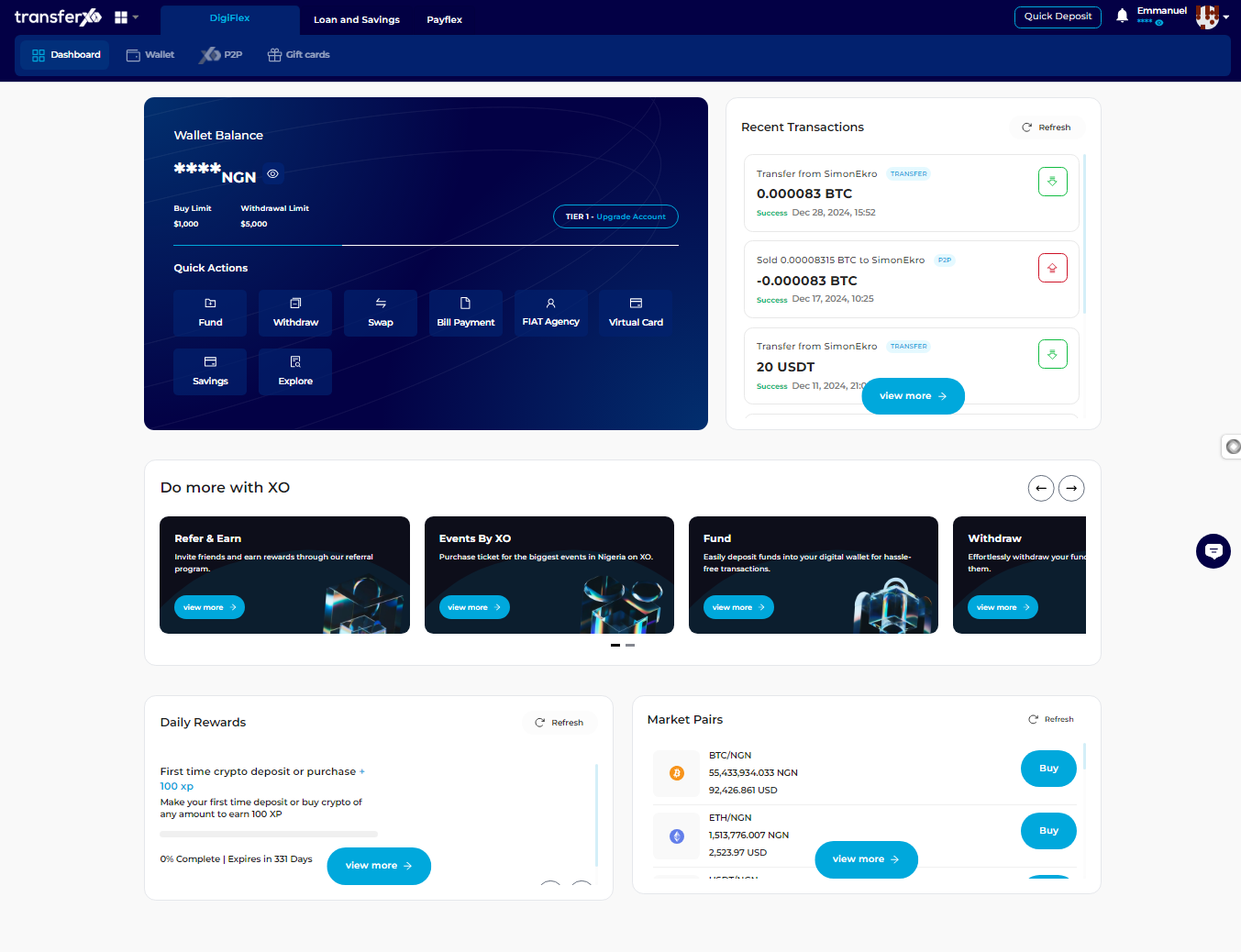

Step 1: Open the TransferXO Web App

Launch your preferred web browser and navigate to the official TransferXO website at transferxo.com.

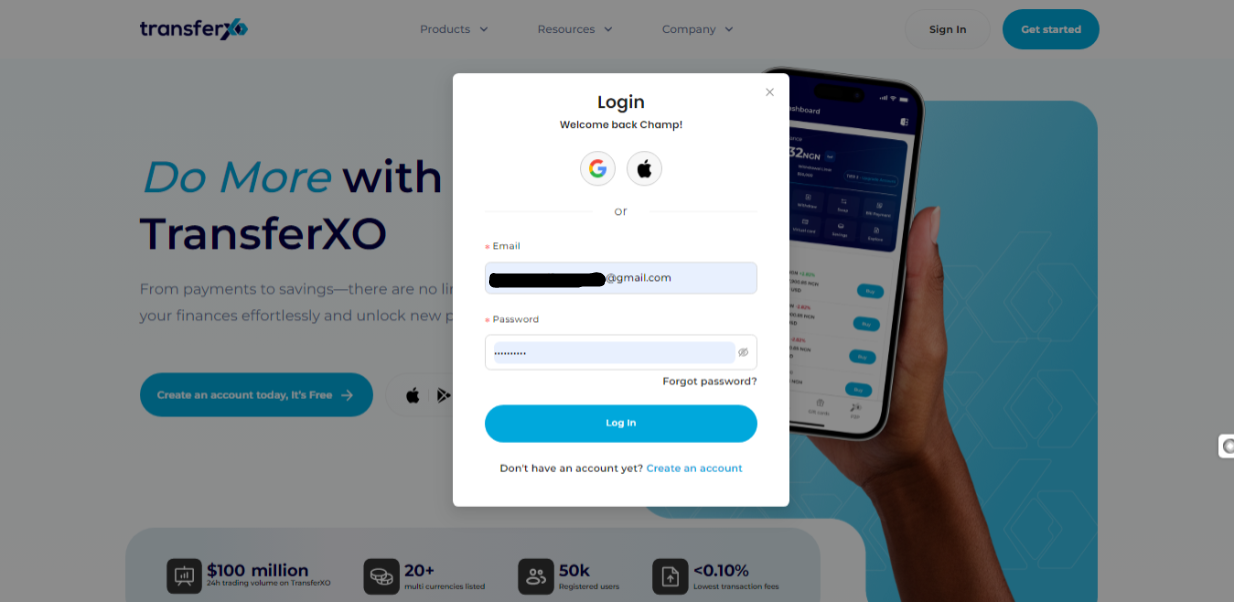

Step 2: Sign In to Your TransferXO Account

Step 3: Access Your Dashboard

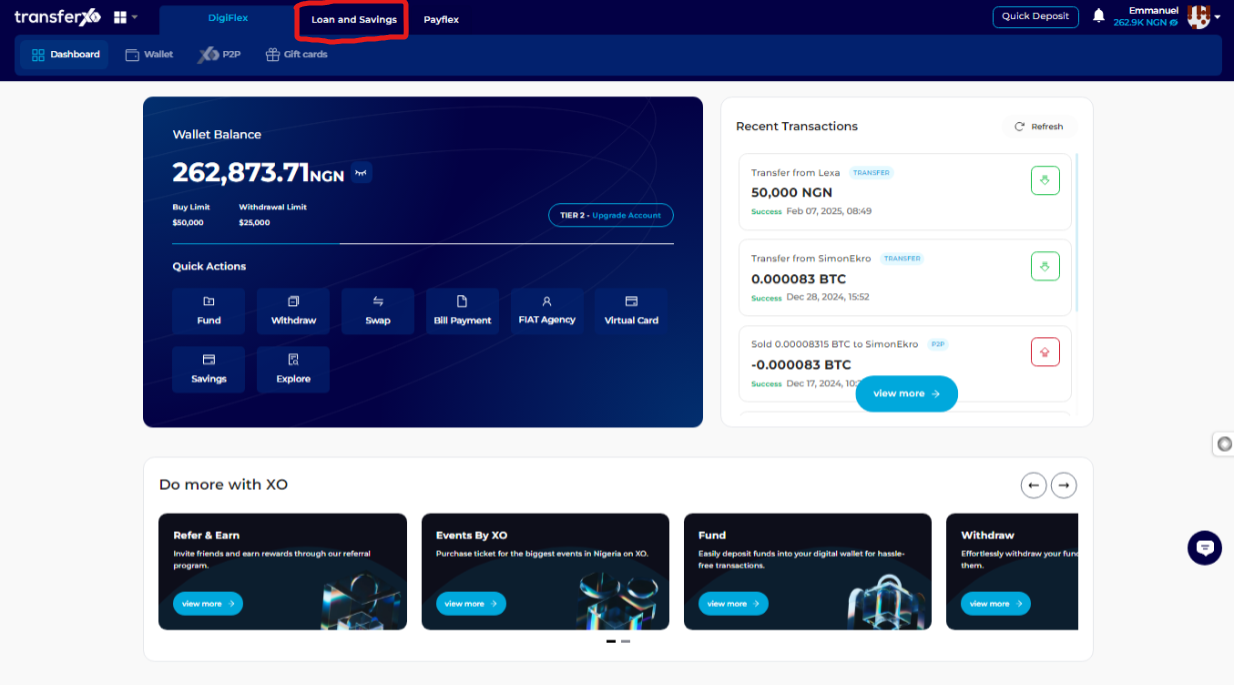

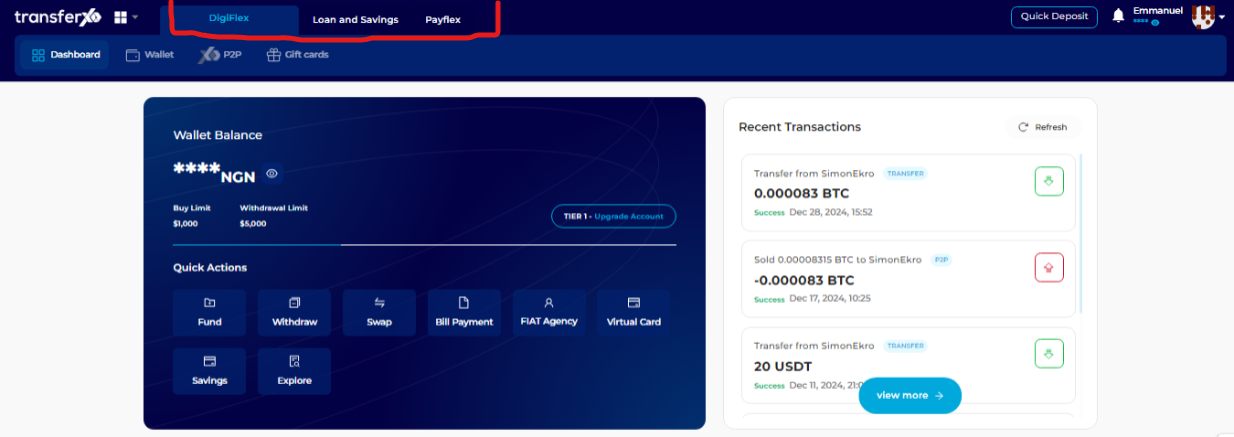

Step 4: Locate the Key Offering Buttons

Right after the TransferXO logo, you will see key offering buttons that allow you to access different features of the platform.

Step 5: Select Loans and Savings

From the Key Offerings panel, click on Loans and Savings to access the relevant interface.

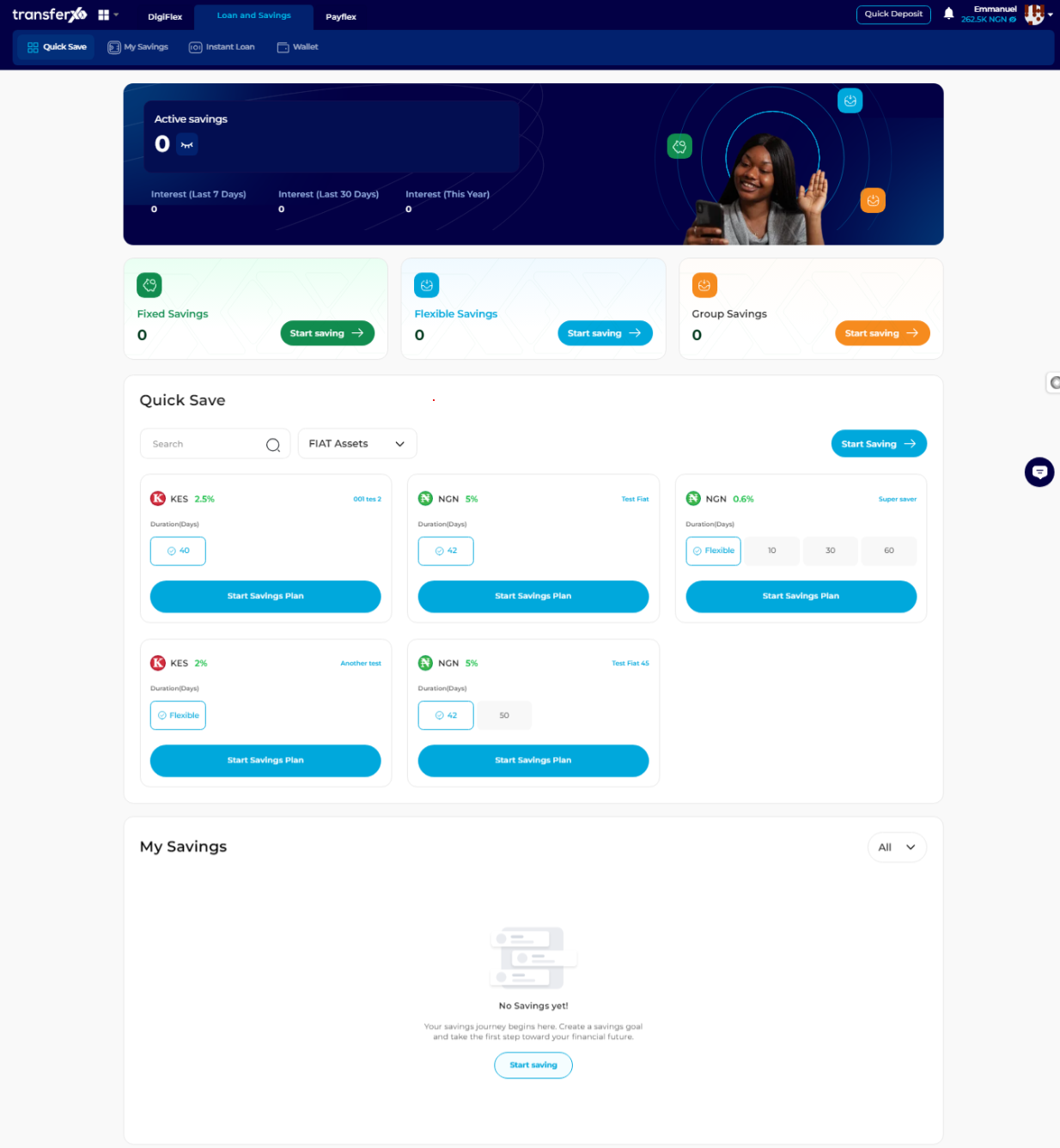

Step 6: Navigate the Loan and Savings Interface

This selection will take you to the Loan and Savings interface, where you can manage and create savings plans.

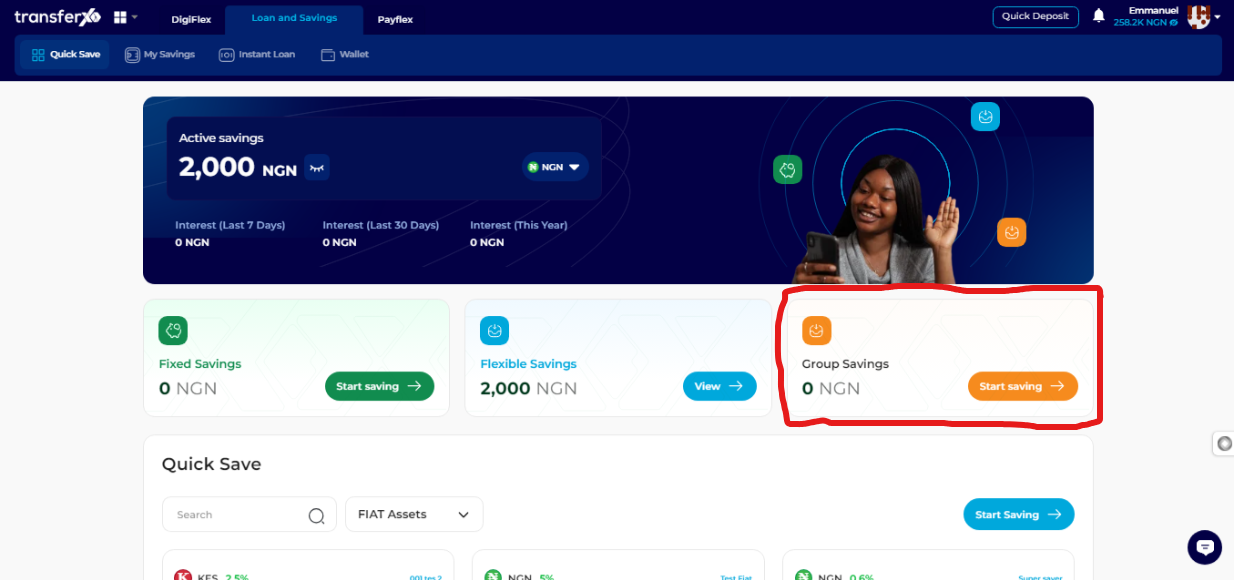

Step 7: Start Group Savings

Locate the Group Savings section on the gold tab and click on Start Saving to initiate a new group savings plan.

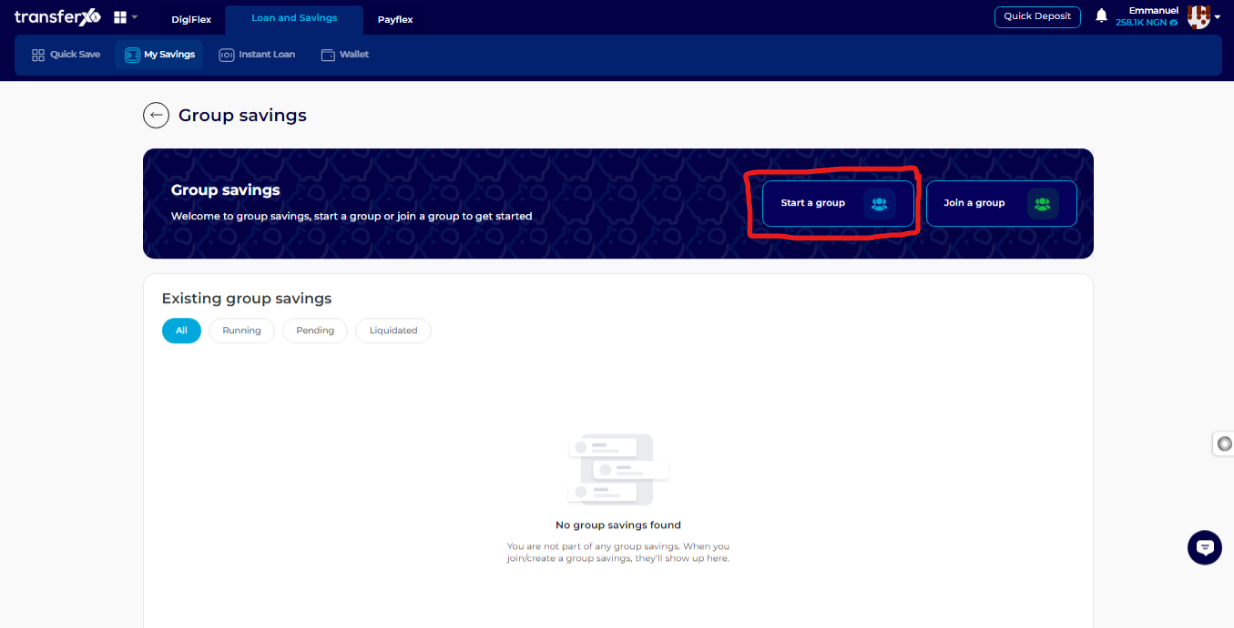

Step 8: Choose to Start a Group

You can either Join a Group or Start a Group. For this guide, we will create a new group savings plan. Click on Start a Group to proceed.

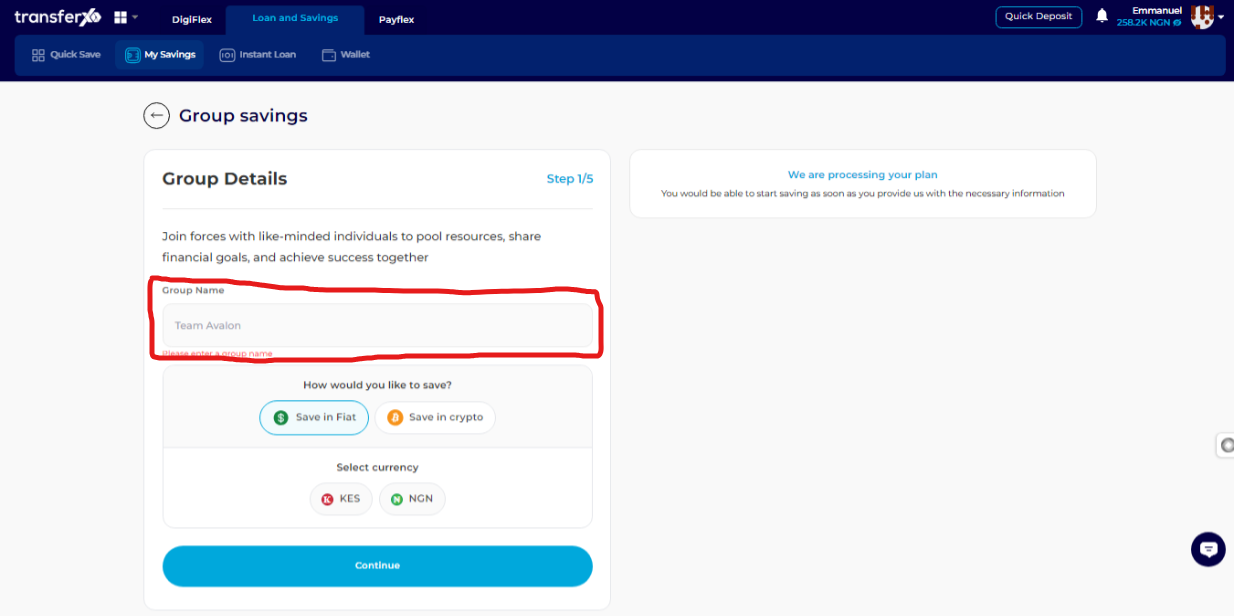

Step 9: Enter a Name for Your Savings Group

Provide a unique and identifiable name for your Group Savings Plan.

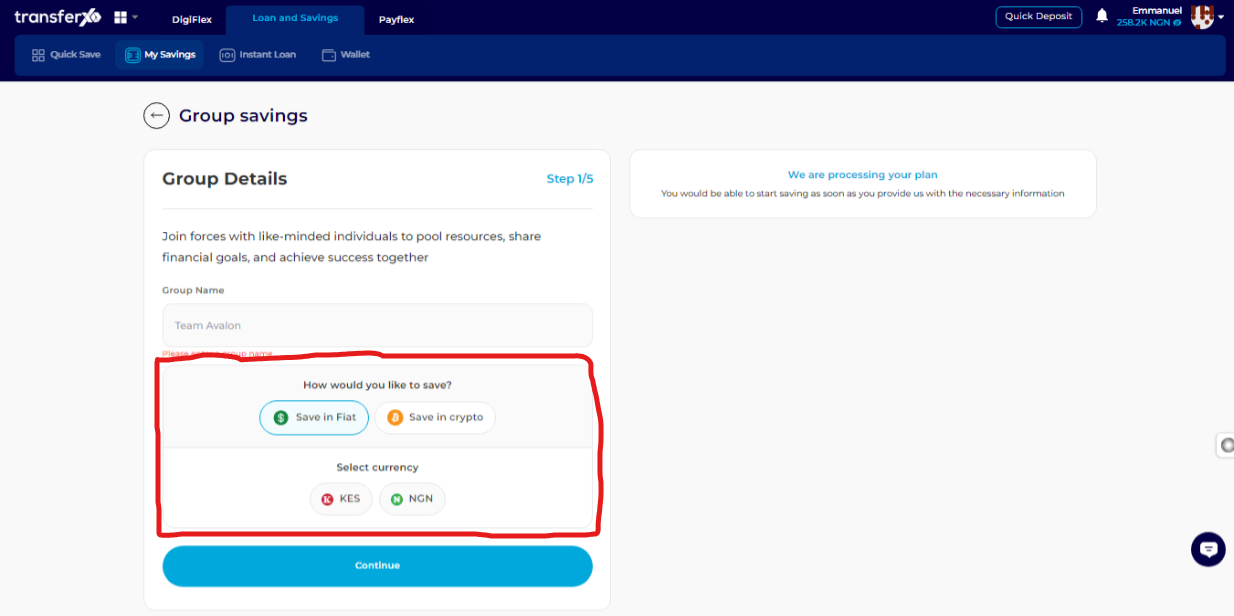

Step 10: Select the Wallet Type and Currency

Choose whether to use a Crypto or Fiat wallet for the savings. Then, select the specific currency or coin for the savings contributions.

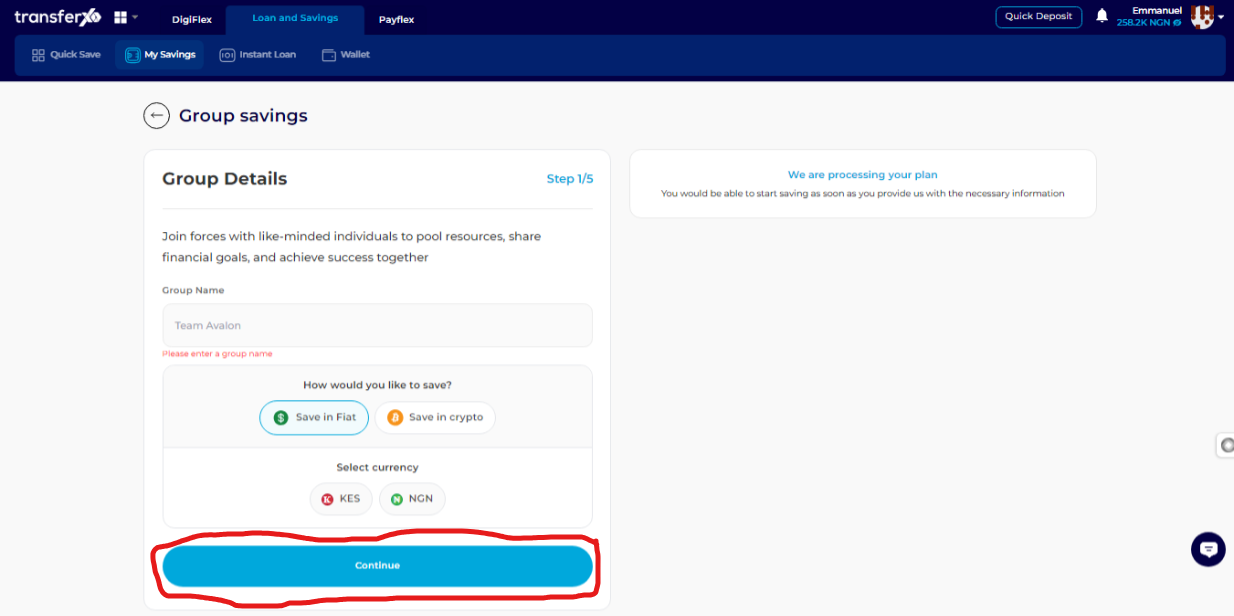

Step 11: Click on Continue

Once you have selected your preferred wallet and currency, click on Continue to proceed.

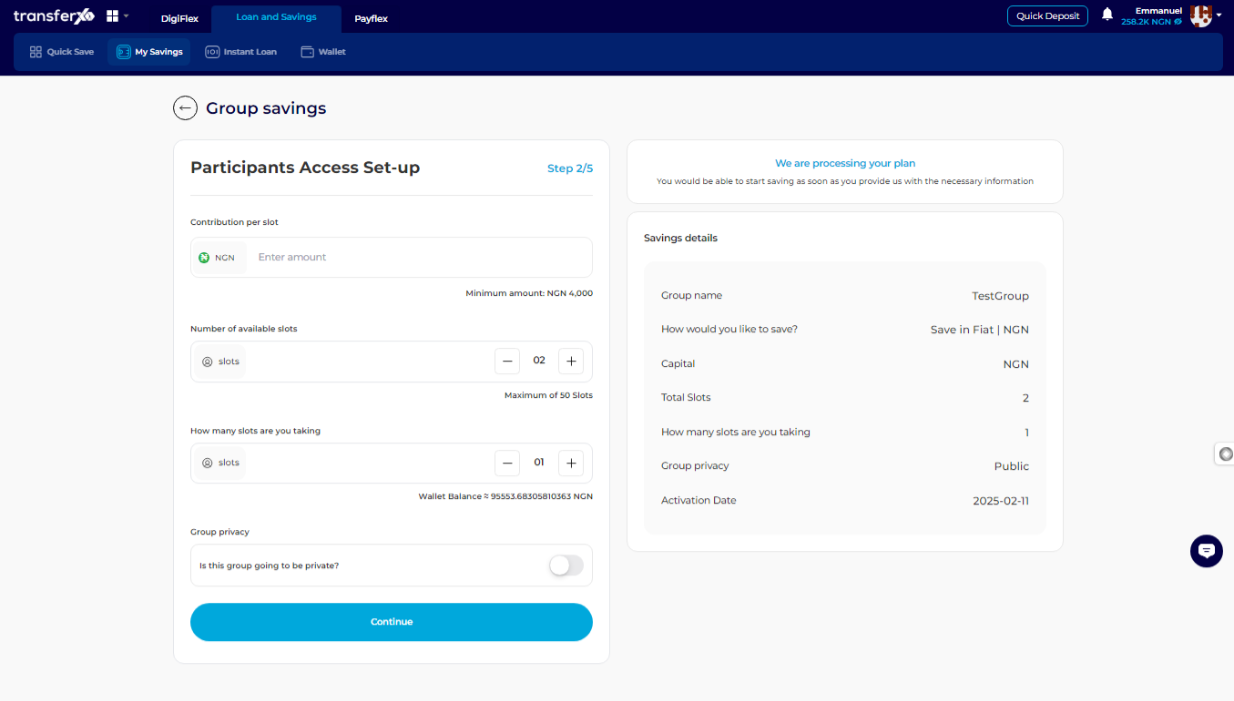

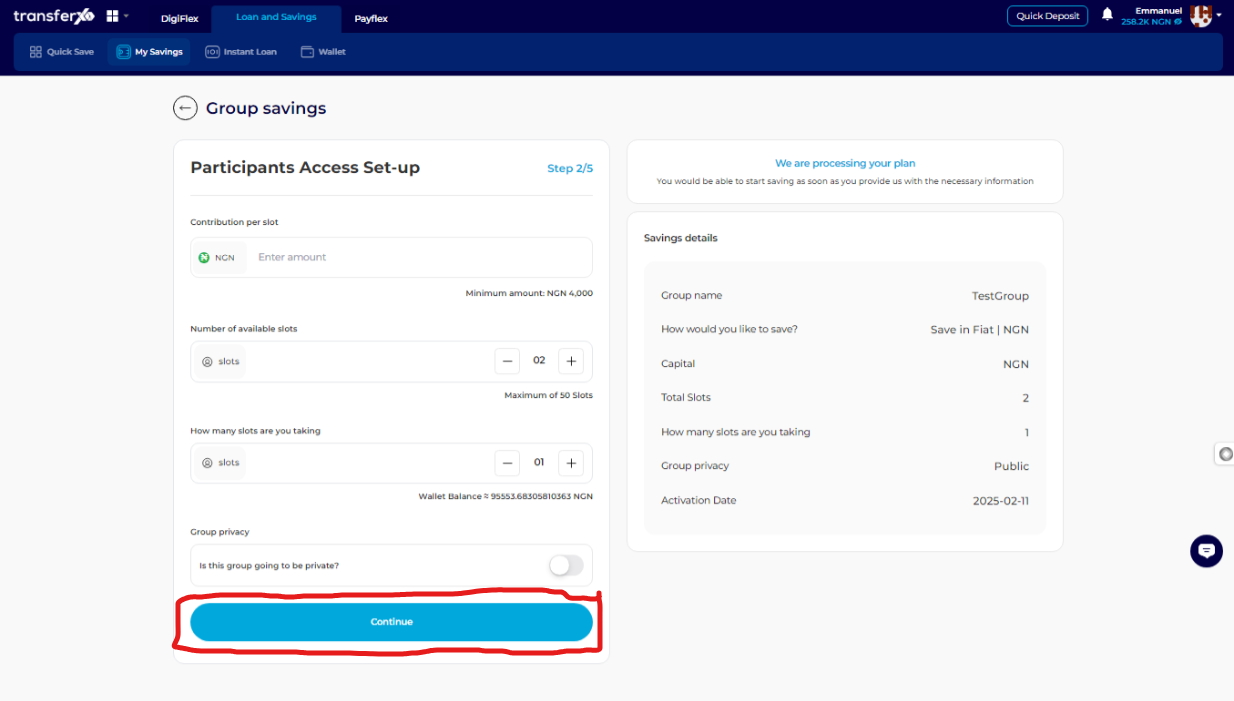

Step 12: Enter Group Savings Details

Provide the required details for the savings group:

Contribution per slot: This is the minimum amount each participant must save. The minimum allowed amount is N4,000, but you can set a higher benchmark.

Number of Slots Available: The number of saving slots that the group can have. You can choose between a minimum of 2 slots and a maximum of 50 slots.

Your Slot Commitment: Specify how many slots you will personally take in the group once it is created.

Group Privacy Settings: Toggle Group Privacy on to make it private or off to keep it public.

Step 13: Click on Continue

Review the details and click Continue to proceed.

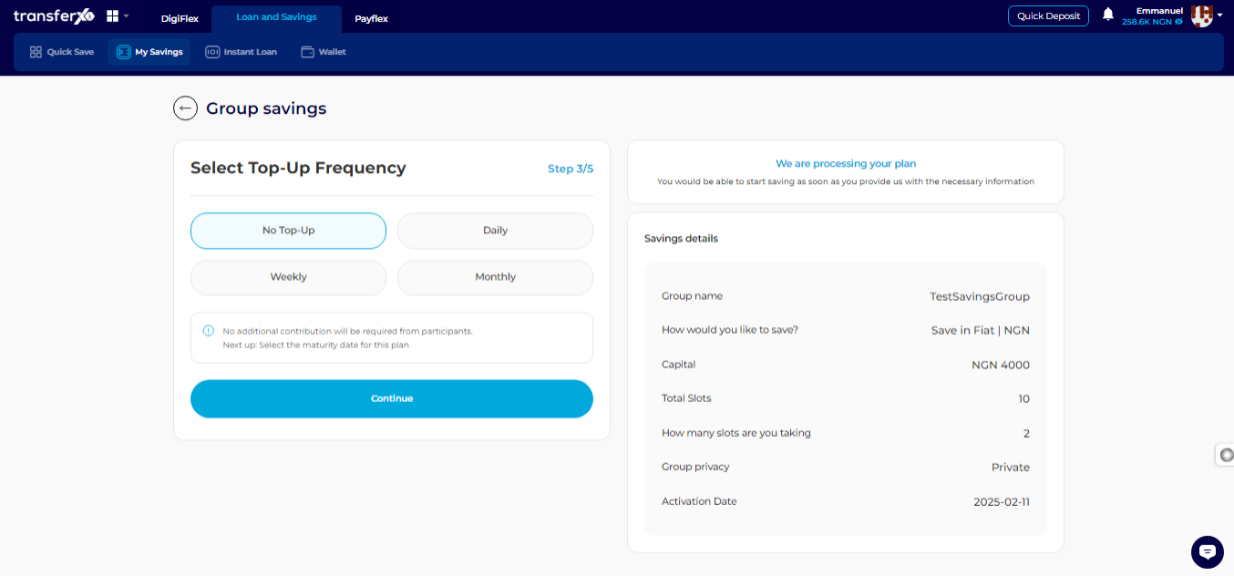

Step 14: Select the Top-up Frequency

Choose how often participants must contribute to the savings:

No Top-up – A one-time deposit with no additional contributions.

Daily – Contributions must be made daily.

Weekly – Participants must top up their savings every week.

Monthly – Contributions are made on a monthly basis.

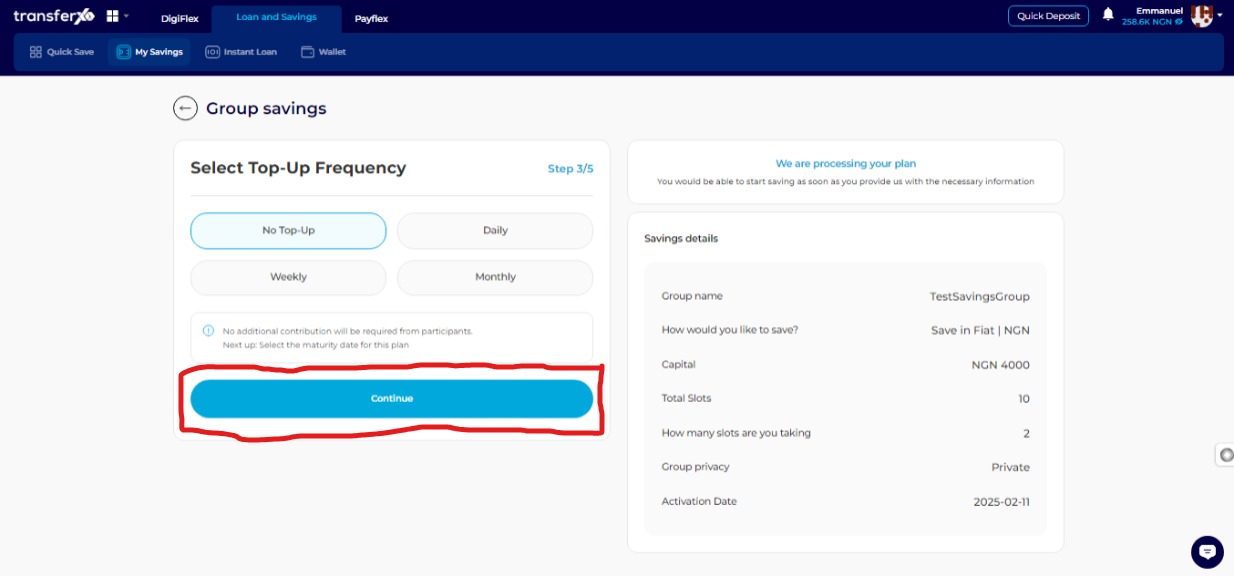

Step 15: Click on Continue

Click Continue to confirm the chosen top-up frequency.

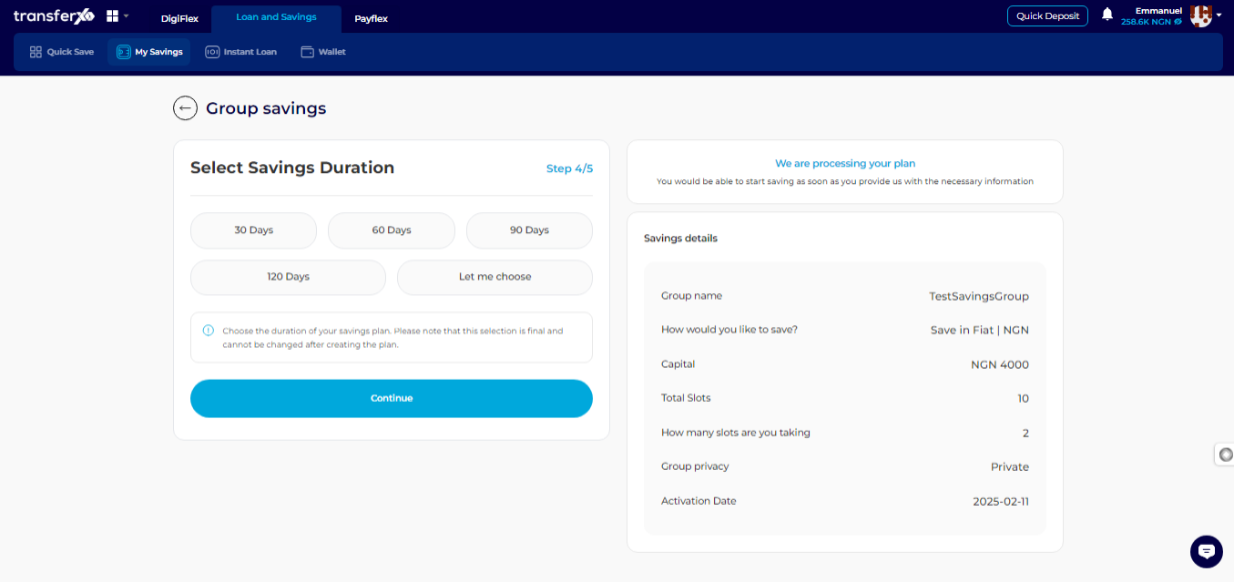

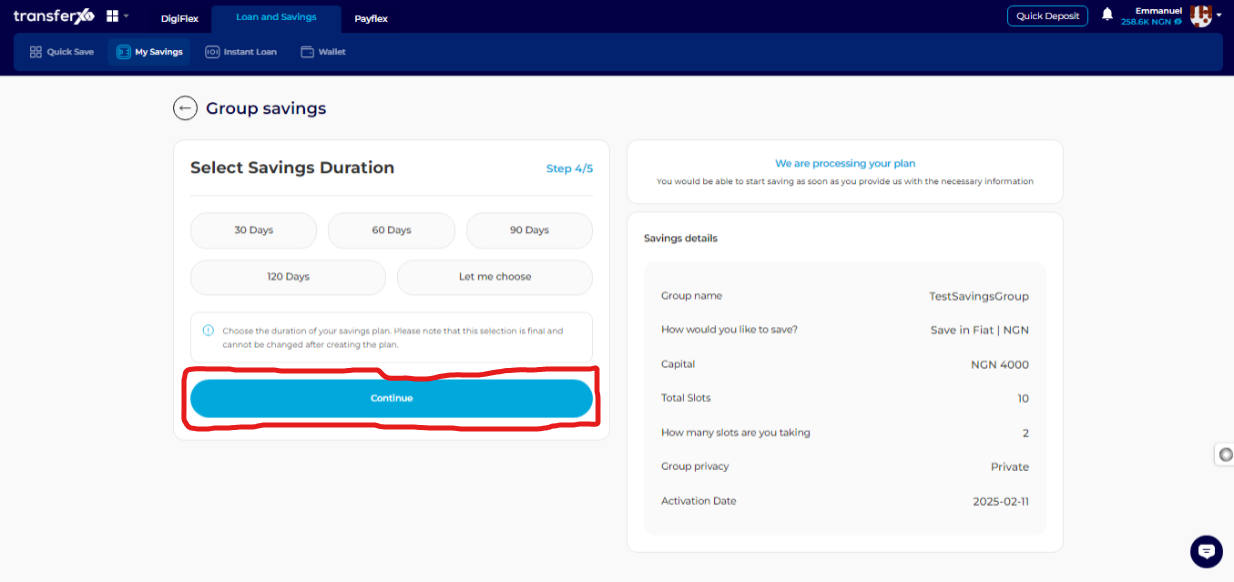

Step 16: Select the Savings Duration

Choose how long the savings plan will last:

30 Days – The savings matures in one month.

60 Days – The savings matures in two months.

90 Days – The savings matures in three months.

120 Days – The savings matures in four months.

Let Me Choose – Allows you to set a specific maturity date manually.

Step 17: Click on Continue

Click Continue to confirm the selected duration.

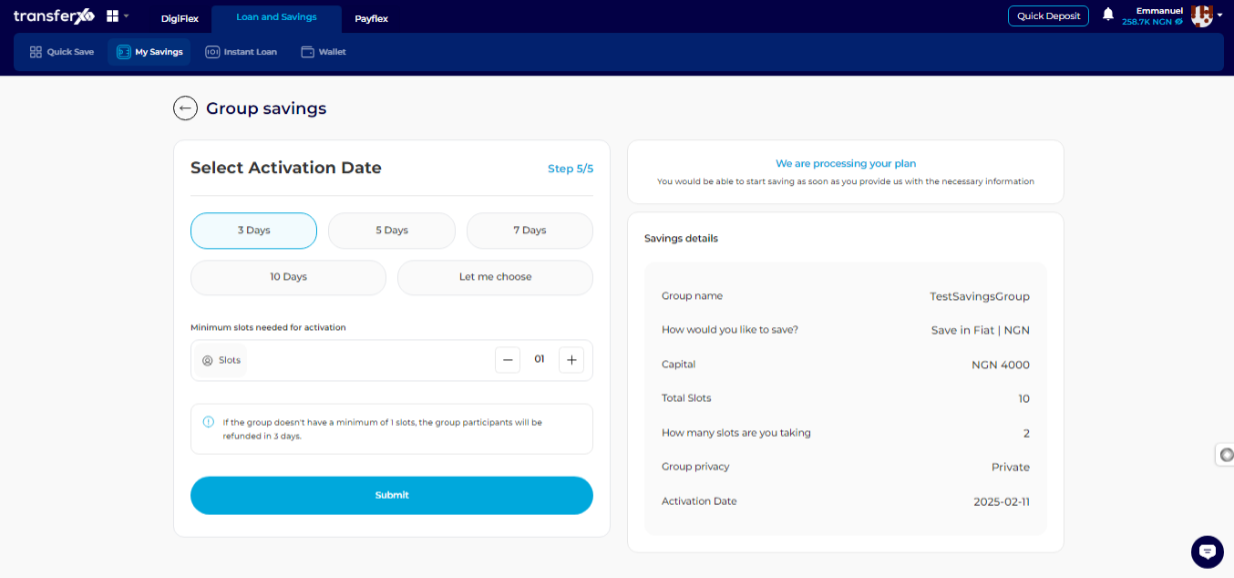

Step 18: Set the Activation Requirements

- Activation Date: Choose the date when the group savings plan will start. This determines when participants must begin saving.

- Minimum Slots for Activation: Set the minimum number of slots required to activate the savings group. If the group does not meet this requirement, participants will be refunded within your set activation period.

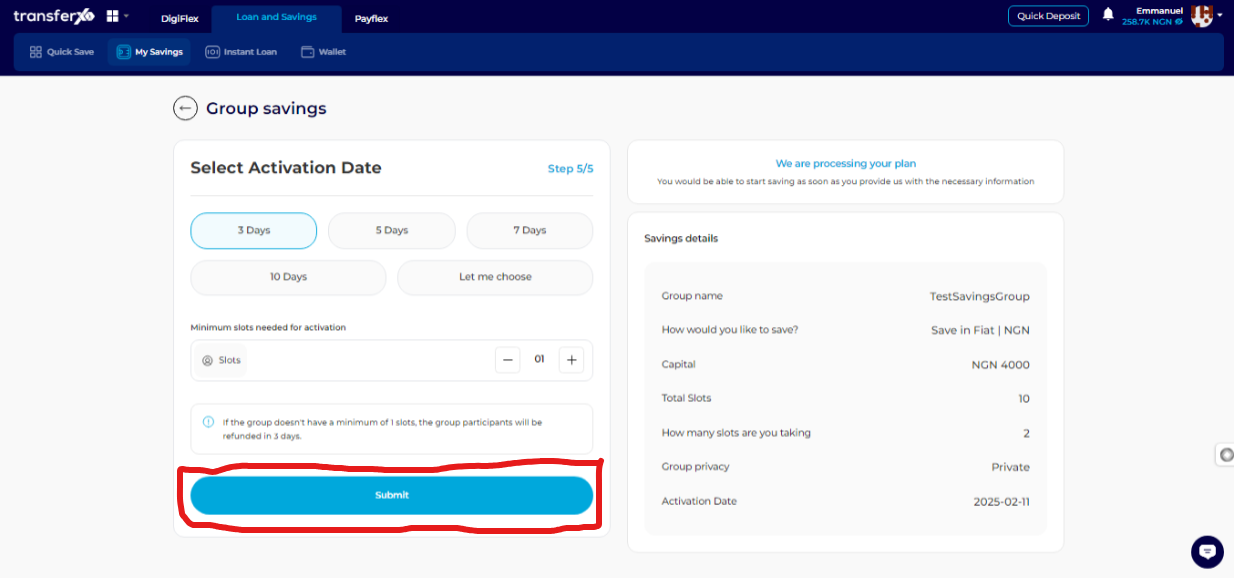

Step 19: Click on Submit

Click Submit to finalize and create your Group Savings Plan.

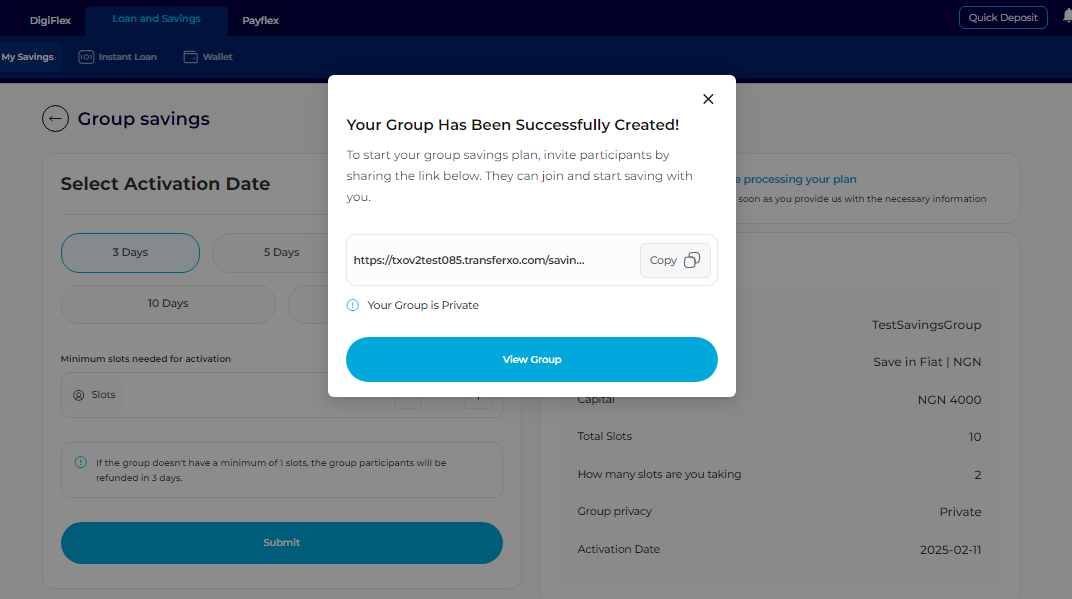

Confirmation and Next Steps

Congratulations! Your Group Savings Plan has been successfully created. You can now:

Click the Copy button in front of the group link to share it with friends and invite them to join.

Click on View Group to check the details of your savings plan.

Starting a Group Savings Plan on TransferXO allows you to save collaboratively with friends, family, or colleagues while benefiting from structured financial planning. By following these steps, you can create a secure and efficient group savings plan that aligns with your financial goals.

Happy saving!